Introduction to Breakout and Breakdown Strategy

The breakout and breakdown strategy is a fundamental trading strategy that relies on identifying key support and resistance levels and waiting for the price to break through these levels to enter a trade. This strategy is characterized by the potential for significant profits in a short time, but it also requires careful risk management.

Chapter 1: Understanding Support and Resistance Levels

Support and resistance levels are price areas where the price tends to bounce from. Support is a price level where the price is expected to find it difficult to fall below, while resistance is a price level where the price is expected to find it difficult to rise above. Accurately identifying these levels is the foundation of the breakout and breakdown strategy.

How to Identify Support and Resistance Levels

- Technical Analysis: Using charts and candlestick patterns to identify areas where the price has bounced in the past.

- Moving Averages: Using moving averages as dynamic support and resistance lines.

- Fibonacci Levels: Using Fibonacci levels to identify potential support and resistance areas.

Chapter 2: Defining Breakout and Breakdown

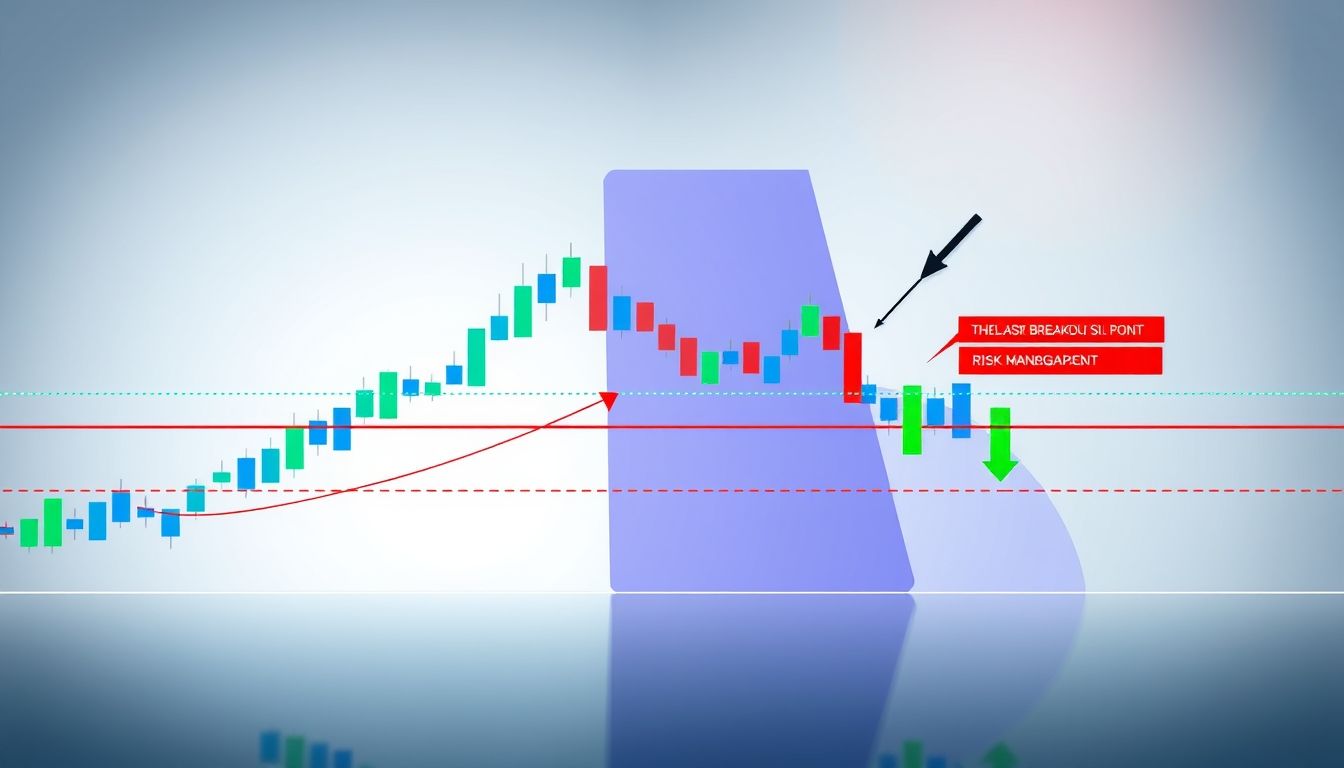

Breakout: Occurs when the price breaks through a significant resistance level, indicating a potential continuation of the upward trend. Breakdown: Occurs when the price breaks through a significant support level, indicating a potential continuation of the downward trend.

Breakouts and breakdowns do not necessarily mean the start of a new trend, but may just be a temporary move (False Breakout). Therefore, it is necessary to confirm the validity of the breakout or breakdown before entering a trade.

Chapter 3: Confirming Breakout and Breakdown

To avoid false breakouts and breakdowns, the validity of the breakout or breakdown must be confirmed using various tools and techniques:

Tools for Confirming Breakout and Breakdown

- Volume: The breakout or breakdown should be accompanied by a significant increase in volume.

- Candlestick Patterns: Looking for strong candles that close above the resistance level or below the support level.

- Retest: Waiting for the price to return to the broken resistance level (to become support) or the broken support level (to become resistance) before entering the trade.

Chapter 4: Strategies for Entering Trades

There are several ways to enter trades after confirming the breakout or breakdown:

Methods of Entering Trades

- Immediate Entry: Entering the trade immediately after confirming the breakout or breakdown.

- Entry After Retest: Waiting for the price to return to the broken support or resistance level before entering the trade.

- Using Pending Stop-Loss Orders: Placing pending stop-loss orders above the resistance level or below the support level before the expected breakout or breakdown.

Chapter 5: Risk Management

Risk management is an essential part of any trading strategy, especially the breakout and breakdown strategy. The trade size and stop-loss level must be determined in advance.

Risk Management Techniques

- Determining Trade Size: The trade size should not exceed a certain percentage of the capital (usually 1-2%).

- Setting Stop-Loss: Setting the stop-loss below the support level or above the broken resistance level.

- Setting Profit Target: Setting the profit target based on the risk/reward ratio.

Chapter 6: Practical Examples from Arab Markets

Let's look at some practical examples from Arab markets to illustrate how to apply the breakout and breakdown strategy:

Example 1: Saudi Stock Market (TASI)

In 2023, the TASI index broke through a significant resistance level at 11,000 points, accompanied by a significant increase in trading volume. This breakout was a strong buy signal, and traders who entered the trade after the breakout were able to achieve good profits.

Example 2: Currency Market in Egypt

In 2024, the exchange rate of the Egyptian pound against the US dollar broke a significant support level, leading to a significant decline in the value of the pound. Traders who anticipated this breakdown were able to profit by selling the Egyptian pound.

Chapter 7: Practical Examples from Global Markets

The breakout and breakdown strategy is applicable in all financial markets around the world:

Example 1: US Stock Market (S&P 500)

In 2022, the S&P 500 index broke a significant support level, leading to a significant decline in the index. Traders who anticipated this breakdown were able to profit by selling stocks.

Example 2: Foreign Exchange Market (EUR/USD)

In 2023, the EUR/USD pair broke through a significant resistance level, leading to a significant increase in the value of the euro. Traders who entered the trade after the breakout were able to achieve good profits.

Chapter 8: Helpful Tools and Software

There are many tools and software that can help traders implement the breakout and breakdown strategy:

Useful Tools and Software

- Trading Platforms: Trading platforms that provide charts and technical analysis tools.

- Technical Analysis Software: Technical analysis software that helps identify support and resistance levels.

- Financial News Services: Financial news services that provide information about economic and political events that may affect the markets.

Chapter 9: Common Mistakes and How to Avoid Them

There are some common mistakes that traders make when using the breakout and breakdown strategy:

Common Mistakes

- Not Confirming the Validity of the Breakout or Breakdown: Entering trades based on false breakouts and breakdowns.

- Not Managing Risk Properly: Not determining the trade size and stop-loss level in advance.

- Emotional Trading: Making decisions based on emotions rather than technical analysis.

Chapter 10: Tips for Aspiring Traders

Here are some tips for aspiring traders who want to master the breakout and breakdown strategy:

Important Tips

- Practice: Practice on a demo account before trading with real money.

- Continuous Learning: Learn more about technical analysis and trading strategies.

- Patience: Patience and waiting for suitable trading opportunities.

- Discipline: Adherence to the trading strategy and risk management.

Important Note: Trading in financial markets involves high risks and may lead to loss of capital. Consult a financial advisor before making any investment decisions.