Introduction to Elliott Wave Theory

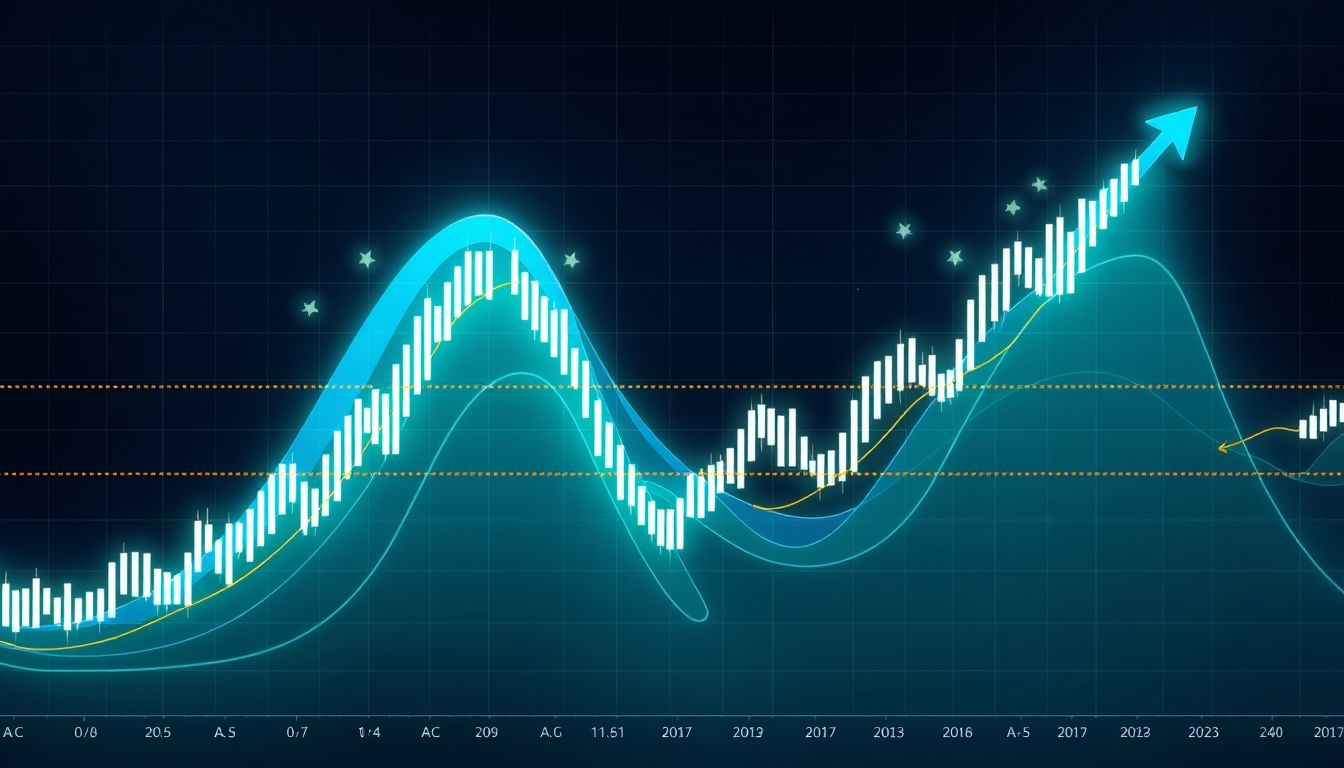

Elliott Wave Theory is a technical analysis approach used to predict the price movement of financial markets. The theory is based on the idea that markets move in specific wave patterns, reflecting the collective psychology of investors. This theory was founded by Ralph Nelson Elliott in the 1930s and is now considered a valuable tool for traders and investors worldwide.

What are Elliott Waves?

Elliott Waves consist of two basic patterns: impulse waves and corrective waves. Impulse waves consist of five waves moving in the direction of the main trend, while corrective waves consist of three waves moving against the main trend.

- Impulse Waves: Consist of five waves (1, 2, 3, 4, 5) and move in the direction of the main trend. Wave 3 is usually the longest and strongest.

- Corrective Waves: Consist of three waves (A, B, C) and move against the main trend, correcting part of the gains made by the impulse waves.

Chapter 1: Basics of Elliott Wave Theory

To fully understand Elliott Wave Theory, we must delve into its basic concepts and recurring patterns. These foundations help the trader to identify waves correctly and predict future price movements.

Basic Rules of Elliott Waves

- Wave 2 cannot exceed the starting point of Wave 1.

- Wave 3 cannot be the shortest among the impulse waves (1, 3, 5).

- Wave 4 cannot overlap with the price area of Wave 1.

Fibonacci Ratios and Their Role in Elliott Waves

Fibonacci ratios, especially 61.8% and 38.2%, play a crucial role in determining potential correction levels and price targets. Fibonacci ratios are often used to identify potential entry and exit points.

Example: If Wave 1 has risen by 100 points, we might expect Wave 2 to correct by 61.8% of this movement, i.e., about 61.8 points.

Chapter 2: Identifying Impulse and Corrective Waves

The ability to accurately identify impulse and corrective waves is key to success in trading with Elliott Wave Theory. This requires a deep understanding of wave patterns and their rules.

How to Identify Impulse Waves

Impulse waves are the waves that push the price in the direction of the main trend. They must follow the basic rules of Elliott Waves, including Wave 2 not exceeding the starting point of Wave 1, Wave 3 not being the shortest, and Wave 4 not overlapping with the price area of Wave 1.

How to Identify Corrective Waves

Corrective waves are the waves that correct part of the gains made by the impulse waves. They usually consist of three waves (A, B, C). Corrective waves can take different forms, such as zigzags, flats, and triangles.

Example: In the Saudi stock market, if we see a strong rise in a particular stock (the impulse wave), we then expect a corrective period (the corrective wave) before the rise resumes.

Chapter 3: Types of Corrective Waves

Corrective waves take different forms, and each form has its distinctive characteristics. Understanding these forms helps in predicting future price behavior.

Zigzag

The zigzag is the simplest type of corrective wave and consists of three waves (A, B, C). Wave A moves against the main trend, Wave B corrects part of Wave A, and Wave C moves in the direction of Wave A and exceeds its end.

Flat

A flat is a corrective wave consisting of three waves (A, B, C) where Wave B is close to the starting level of Wave A, and Wave C is close to the ending level of Wave A.

Triangles

Triangles are corrective waves consisting of five waves that move convergently to form a triangle shape. Triangles can be converging or diverging.

Chapter 4: Using Fibonacci Ratios in Trading

Fibonacci ratios are a powerful tool for identifying potential support and resistance levels, price targets, and potential entry and exit points. Fibonacci ratios are an integral part of Elliott Wave Theory.

Fibonacci Retracements

Fibonacci retracements are used to identify potential support and resistance levels. These levels are calculated by applying Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, 78.6%) to a previous price movement.

Example: If a stock price has risen from 100 SAR to 150 SAR, Fibonacci retracements can be used to identify potential support levels at 138.2 SAR (23.6%), 130.9 SAR (38.2%), and 125 SAR (50%).

Fibonacci Extensions

Fibonacci extensions are used to identify potential price targets. These targets are calculated by applying Fibonacci ratios (61.8%, 100%, 161.8%) to a previous price movement.

Example: If Wave 1 has risen by 50 points, Fibonacci extensions can be used to identify potential price targets at 50 points (100%) and 80.9 points (161.8%).

Chapter 5: Trading Strategies Using Elliott Waves

After understanding the basics of Elliott Wave Theory and Fibonacci ratios, effective trading strategies can be developed to achieve profits.

Trend Following Strategy

This strategy is based on trading in the direction of the main trend. Buy trades are entered when Wave 3 begins, and exit when Wave 5 approaches its end.

Counter-Trend Trading Strategy

This strategy is based on trading against the main trend. Sell trades are entered when the corrective wave (A, B, C) begins, and exit when Wave C approaches its end.

Risk Management in Trading Using Elliott Waves

Risk management is an essential part of any successful trading strategy. The trade size, stop-loss level, and take-profit level must be determined before entering any trade.

Example: The stop-loss level can be set directly below the support level, and the take-profit level can be set at the potential resistance level.

Chapter 6: Practical Examples from the Arab and Global Markets

To illustrate how to apply Elliott Wave Theory in trading, we will review some practical examples from the Arab and global markets.

Analyzing Saudi Aramco Stock Using Elliott Waves

Elliott Wave Theory can be used to analyze the price movement of Saudi Aramco stock and predict its future trends. For example, if we see a strong impulse wave pattern, we may expect the price to continue to rise.

Analyzing the MSCI World Index Using Elliott Waves

Elliott Wave Theory can be used to analyze the movement of the MSCI World Index and predict its future trends. For example, if we see a corrective wave pattern, we may expect a period of decline or fluctuation.

Chapter 7: Common Mistakes in Trading Using Elliott Waves

Many traders make common mistakes when using Elliott Wave Theory. Avoiding these mistakes can greatly improve trading results.

Incorrectly Identifying Waves

One common mistake is identifying waves incorrectly. Ensure that the waves follow the basic rules of Elliott Waves and that the wave patterns are clear.

Not Using Fibonacci Ratios Correctly

Fibonacci ratios are a powerful tool, but they must be used correctly. Ensure that Fibonacci ratios are applied to the appropriate price movements and used to identify potential support and resistance levels and price targets.

Not Managing Risk Effectively

Risk management is an essential part of any successful trading strategy. The trade size, stop-loss level, and take-profit level must be determined before entering any trade.

Chapter 8: Tools and Resources to Help Traders

There are many tools and resources available to help traders apply Elliott Wave Theory.

Technical Analysis Software

There are many technical analysis software programs that provide tools for identifying waves and drawing Fibonacci ratios. Some of these programs include TradingView and MetaTrader.

Specialized Websites and Forums

There are many websites and forums specializing in Elliott Wave Theory where traders can exchange ideas and analyses. Some of these sites include Elliott Wave International and Elliott Wave Theory.

Chapter 9: Tips for Improving Trading Skills Using Elliott Waves

To improve trading skills using Elliott Waves, you must continue to learn and practice.

Continuous Practice

Continuous practice is the key to improving trading skills. Analyze charts, identify waves, and draw Fibonacci ratios regularly.

Learning from Mistakes

Everyone makes mistakes in trading. Learn from mistakes and avoid repeating them in the future.

Staying Up-to-Date with Market News

Stay up-to-date with market news and economic events that may affect prices.

Chapter 10: The Future of Elliott Wave Theory in Financial Markets

Elliott Wave Theory remains a valuable tool for traders and investors worldwide. Despite some criticisms, the theory continues to evolve and adapt to changes in financial markets.

Modern Developments in Elliott Wave Theory

Modern developments in Elliott Wave Theory include the use of artificial intelligence and machine learning to improve the accuracy of predictions.

The Impact of Technology on the Application of Elliott Wave Theory

Technology allows traders to access more data and tools, making it easier to apply Elliott Wave Theory and make better trading decisions.

Conclusion: Elliott Wave Theory is a powerful tool for analyzing financial markets, but it requires a deep understanding and continuous practice. By applying this theory correctly, traders can improve their investment decisions and increase their profits.