Introduction to Elliott Wave Theory

Elliott Wave Theory is a form of technical analysis used to forecast price trends in financial markets. The theory is based on the idea that market prices move in specific patterns called "waves." This theory was developed in the 1930s by Ralph Nelson Elliott, who observed that these patterns recur in different markets and on different time frames.

Importance of Understanding Elliott Wave Theory

Understanding Elliott Wave Theory can help traders:

- Identify potential entry and exit points.

- Estimate potential price targets.

- Manage risk more effectively.

- Understand the broader context of market movement.

Fundamentals of Elliott Wave Theory

Impulse Waves

Impulse waves consist of five waves and move in the direction of the prevailing trend. These waves are numbered from 1 to 5. Waves 1, 3, and 5 are impulse waves, while waves 2 and 4 are corrective waves.

Characteristics of Impulse Waves:

- Wave 2 cannot retrace beyond the start of wave 1.

- Wave 3 cannot be the shortest of waves 1, 3, and 5.

- Wave 4 cannot overlap the price territory of wave 1.

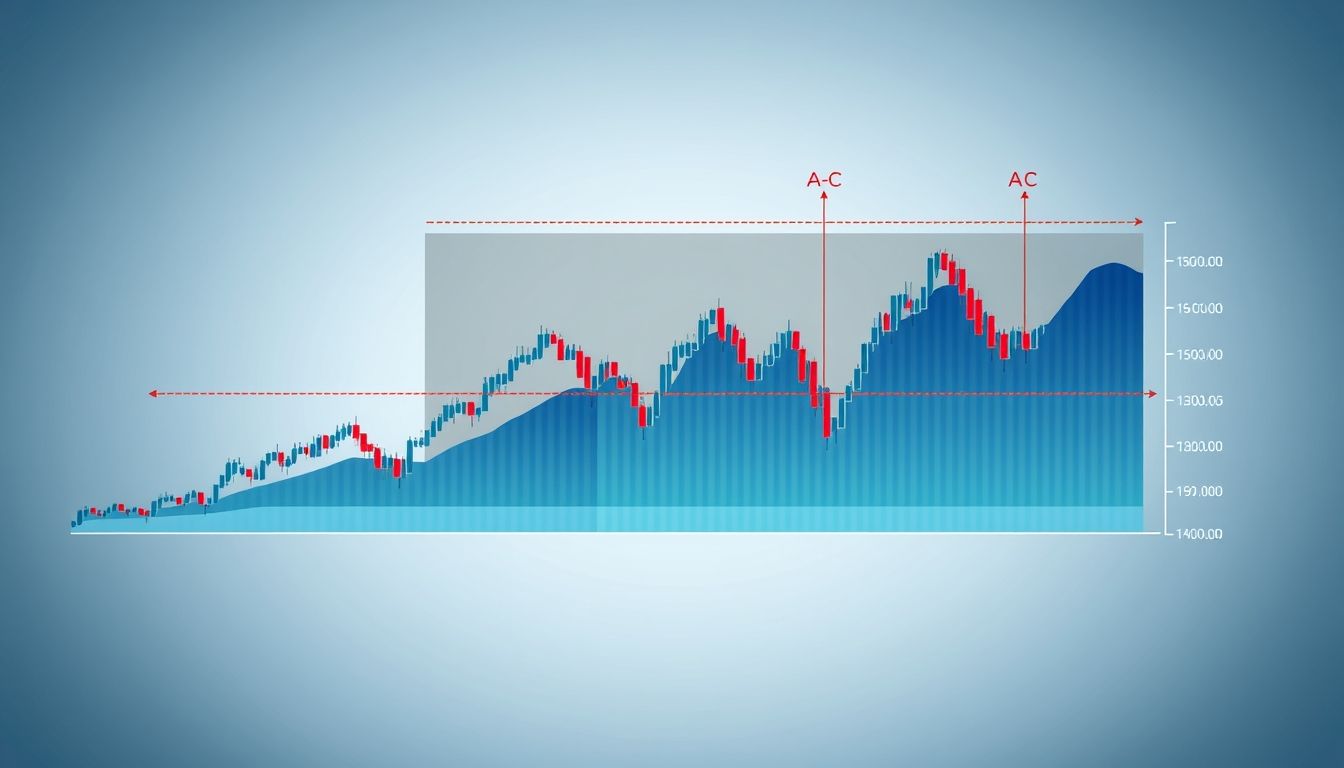

Corrective Waves

Corrective waves follow impulse waves and consist of three waves numbered A, B, and C. These waves move against the direction of the prevailing trend.

Types of Corrective Waves:

- Zigzag: A sharp corrective pattern.

- Flat: A sideways corrective pattern.

- Triangle: A contracting corrective pattern.

Rules of Elliott Wave Theory

Rule 1: Wave 2 Cannot Retrace Beyond the Start of Wave 1

This rule is essential for determining the validity of an impulse wave. If wave 2 retraces beyond the start of wave 1, it indicates that the wave count is incorrect.

Rule 2: Wave 3 Cannot Be the Shortest of Waves 1, 3, and 5

Wave 3 is often the longest and most powerful wave in the impulse wave. If wave 3 is the shortest, it may indicate weakness in the prevailing trend.

Rule 3: Wave 4 Cannot Overlap the Price Territory of Wave 1

This rule helps in determining whether the impulse wave is valid. If wave 4 overlaps the price territory of wave 1, it indicates that the wave count is incorrect.

Practical Applications of Elliott Wave Theory in Trading

Identifying Entry and Exit Points

Elliott Wave Theory can be used to identify potential entry and exit points in the market. For example, traders can buy at the beginning of wave 3, as it is expected to be the longest and most powerful wave.

Estimating Price Targets

Fibonacci ratios can be used to determine potential price targets for waves. For example, wave 3 often extends to 161.8% of the length of wave 1.

Risk Management

Elliott Wave Theory can be used to set stop-loss levels. For example, a stop-loss can be placed below the start of wave 1 to protect capital.

Examples from the Arab and Global Markets

Example in the Saudi Stock Market (Tadawul)

During periods of growth in the Saudi stock market, clear Elliott Wave patterns can be observed. For example, in 2021, the general index saw a significant rise that can be analyzed using Elliott Waves to identify ideal entry and exit points.

Example in the Foreign Exchange Market (Forex)

Elliott Wave Theory can be applied to the EUR/USD currency pair. For example, during periods of market volatility due to economic events, Elliott Waves can be used to predict potential price trends.

Advantages and Disadvantages of Elliott Wave Theory

Advantages

- Helps in understanding the broader context of market movement.

- Provides a framework for identifying potential entry and exit points.

- Can be used in different markets and on different time frames.

Disadvantages

- Relies on subjective interpretation, which can lead to biases.

- Can be complex and difficult to understand for beginners.

- Not always accurate and may require the use of other analysis tools to confirm signals.

Practical Tips for Applying Elliott Wave Theory

Use Other Analysis Tools

Do not rely solely on Elliott Wave Theory. Use other technical analysis tools such as moving averages, Relative Strength Index (RSI), and MACD to confirm signals.

Practice on Historical Charts

Before starting live trading, practice analyzing historical charts to develop your wave identification skills.

Be Patient and Disciplined

It may take time to identify waves correctly. Be patient and disciplined, and do not rush into making decisions.

Additional Tools and Resources for Learning Elliott Wave Theory

Books

- "Mastering Elliott Wave" by Glenn Neely

- "Elliott Wave Principle" by A.J. Frost and Robert Prechter

Websites

- Elliott Wave International

- Investopedia

Training Courses

Look for online or local training courses to learn Elliott Wave Theory from experts.

Common Mistakes When Using Elliott Wave Theory

Interpretation Bias

One common mistake is interpreting waves to confirm your own viewpoint. Try to be as objective as possible.

Failure to Confirm Signals

Do not rely solely on Elliott Wave Theory. Use other analysis tools to confirm signals before making decisions.

Emotional Trading

Avoid emotional trading. Stick to your plan and strategy, and do not let fear or greed influence your decisions.

The Future of Elliott Wave Theory

Elliott Wave Theory remains a valuable tool for traders and investors despite advancements in technical analysis. As financial markets evolve, traders must adapt and refine their use of the theory by integrating it with other tools and techniques. Staying informed about the latest developments in Elliott Wave Theory and market analysis will help traders make informed decisions and achieve trading success.